View your account

If you need assistance, please contact

Customer Care Center at 215-788-1234

Life moves fast. You need a bank that understands your changing needs. Penn Community Bank offers the financial services and the data-driven insight to help you and your family thrive. Whether you’re spending, saving, or borrowing, we have a solution that will help you grow.

Healthy businesses are the foundation of a thriving community and local economy. Penn Community Bank offers the financial tools and services that area businesses need to grow, from business checking and savings accounts to flexible financing options.

The inherent elements and attributes that drive our brand promise.

Part of our commitment to our customers is making sure that they have access to not just…

Part of our commitment to our customers is making sure that they have access to not just… the financial tools, but the advice and guidance they need to grow. As the largest mutual bank in eastern PA, our people are knowledgeable in all aspects of the business. Plus, our integrated structure ensures the needs of our clients come first.

When we work with our customers, we’re in it together. Their growth is our growth…

When we work with our customers, we’re in it together. Their growth is our growth… And we support them, their families, and their businesses as part of our community.

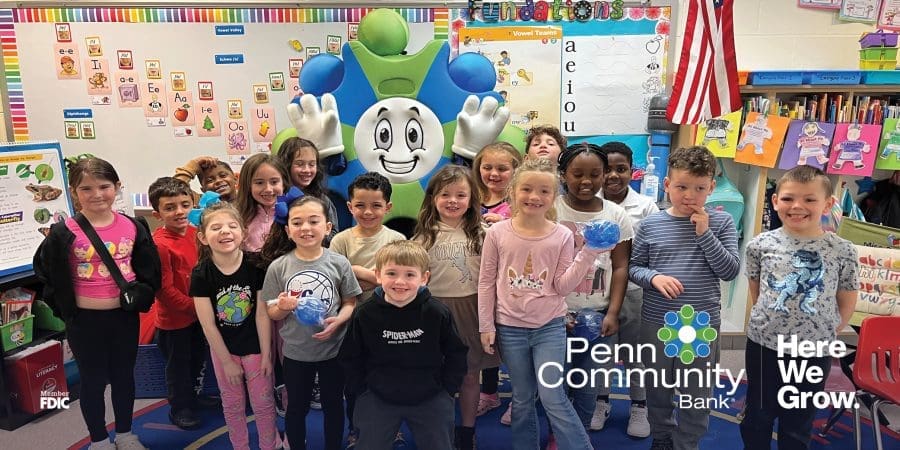

As a community stronghold, we take our responsibility to grow and improve our…

As a community stronghold, we take our responsibility to grow and improve our… community seriously. From our commitment to giving back 5% of our net income to our communities, to our team members volunteering at the ground level. And our mutual structure means that we are beholden to our customers, not shareholders.

Our name is Penn Community Bank, and we truly live up to all aspects of it. We maintain…

Our name is Penn Community Bank, and we truly live up to all aspects of it. We maintain… a strong presence and get involved in the communities where we operate, becoming a trusted and integral partner that meets people where they are.

Penn Community Bank, together with SavvyMoney, gives you the tools and insight you need to understand, track, and improve your credit right from online or mobile banking. SavvyMoney is the best credit score information service out there if you’re looking to crack the code of credit ratings or learn how the information on your credit reports translates into a score.

We have partnered with Zelle®️ to bring you a fast, safe, and easy way to send and receive money. Available right from online and mobile banking so you don’t need to download anything new to start sending and receiving money! Get started with simpler, faster ways to manage your finances today.

blog

The month of April serves to raise awareness about the importance of understanding finances and provides an opportunity for individuals, […]

post_press_release

‘Mutual Interest’ features economic outlook, customer success stories, content for business PERKASIE, Pa. (April 2024) – Penn Community Bank, the […]

post_press_release

‘We are committed to promoting policies that allow our communities to thrive and our institutions to better meet the financial […]